Rating: BUY

Current Price: $95.55

Price Target: $136.20

Thesis:

We own Union Pacific because it is a great business and the stock is currently undervalued. It’s a great business because Union Pacific has a significant amount of pricing power, access to strategic ports, room for increased efficiency and it will grow as the US economy grows. It is currently undervalued because of a decline in coal shipments (natural gas’s current price makes it a cheap substitute) and because of an extended west coast port shutdown. However the decline in revenue from coal is temporary because if coal shipments don’t revert to higher levels then Union Pacific will replace it with shipments of other goods. Also the west coast port shutdown is mostly temporary.

We value Union Pacific at $136.20 per share using a 50/50 combination of discounted cash flow analysis and a valuation formula first published by Benjamin Graham (Warren Buffett’s mentor) in the 1940’s.

Pricing Power:

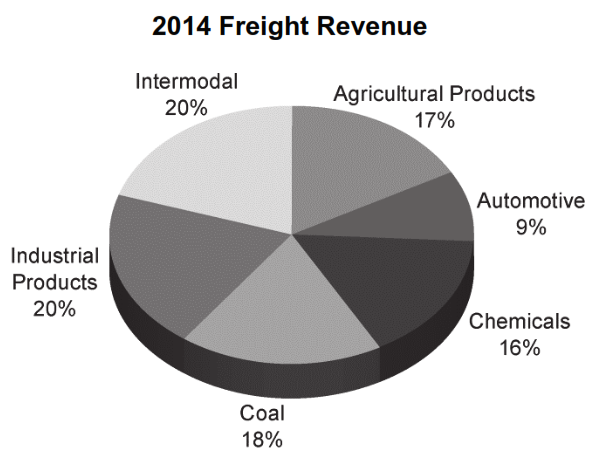

According to Warren Buffett “the single most important decision in evaluating a business is pricing power,” and Union Pacific has a tremendous amount of pricing power over its customers. Buffet claims “if you’ve got the power to raise prices without losing business to a competitor, you’ve got a very good business. And if you have to have a prayer session before raising the price by 10 percent, then you’ve got a terrible business.” Through its fuel surcharge program, Union Pacific has the power to raise the price of its railroad services according to fuel prices, and this is one of the reasons UNP is a very good business. Additionally, there is more railroad demand than there is supply (people often use trucks and barges when they can’t use railroads), and this also gives UNP pricing power. When demand for one line of UNP’s business softens (for example coal) UNP can offset the softening with another line of business (for example Agricultural products).

Access to Strategic Ports:

UNP also has access to strategic Pacific Coast and Gulf of Mexico ports which are barriers to entry for competitors, as well as serving all six major gateways to Mexico (also a barrier for others to reproduce). Union Pacific’s railways are an integral part of the United States transportation infrastructure, and conveniently connect to a variety of other railroads and modes of transportation.

Room for Increased Efficiency:

Even though railroads are already a more efficient and less expensive form of transportation than trucking (another common form of transportation), there is still room for increased efficiency. According to the CEO of another US railroad company, Burlington Northern Santa Fe, long-haul trains are three times more fuel efficient than trucks. Additionally, “William Nickle, supply chain and operations management professor at Rutgers University Business School MBA Program, explained… “One of the biggest differences between roads and railroads is that the infrastructure for trains is financed by private individuals, and the infrastructure for trucks (roadways, bridges, etc.) is financed by the government. A government that is as in as much debt as ours has not been able to invest enough to revitalize and resolve all of the current issues with the infrastructure the trucking industry relies upon.” Of course, there is still a need for intermodal transport, such trucks (and some trains) to take the freight the final leg of its journey to its destination.

Valuation:

Discounted Cash Flow (DCF) Analysis

A DCF analysis suggests Union Pacific is worth $145.66 per share. Union Pacific’s 2014 Free Cash Flow was around $3.14 billion (We're calculating this as Cash from Operations (+$7.385) minus Capital Expenditures (-$4.346) and adjusting for other Investing Cash Flow Items (+$0.097)). We're assuming UNP’s required rate of return is 7.5% (this is essentially a long-term equity market assumption). We also assume UNP can grow about 3.5% per year organically, and it’s FCF per share outstanding can grow another 1.5% per year simply by way of continued share repurchases resulting in higher future free cash flow per share because there will be less shares outstanding: FCF / (r-g) = $3.2 billion / (0.075 – (0.035 + 0.015)) = $128 billion. $128 billion / 0.87878 billion shares outstanding = $145.66 per share.

Ben Graham Formula:

We also like to use a valuation formula first published by Benjamin Graham (Warren Buffett’s mentor) in the 1940’s: EPS x (8.5 + (2 x growth)). Assuming 2016 earnings per share (EPS) of $6.85 (taken from 29 professional analyst estimates on YahooFinance), and a growth rate of 5% (this is the same growth rate used in the DCF model above. This results in a share price of $126.73 = 6.85 x 8.5 + 2 x 5.

Risks:

Union Pacific outlines a variety of risk factors in their annual report, and it is worth reviewing some of them here. First, UNP explains:

“We Must Manage Fluctuating Demand for Our Services and Network Capacity.” This risk is apparent in the slowdown in coal transport demand in the first half of 2015 which negatively impacted the stock price, and created a more favorable entry point for “would be” buyers of the stock. UNP must now manage this risk by either waiting for coal business to revert back upward to historical levels, or make the changes in the mix of shipments to replace lost revenues.

“We Are Subject to Significant Environmental Laws and Regulations.” In some sense, this risk may have been reduced by the recent Supreme Court ruling against the Environmental Protection Agency which said the agency didn’t take into enough consideration the cost impact of new regulations. While this ruling doesn’t directly impact UNP, it does impact coal plants, and it does create a regulatory environment less hostile to business.

“Strikes or Work Stoppages Could Adversely Affect Our Operations.” This is a big one as a large percent of the workforce is unionized which can lead to significant work stoppages. Also, this can impact shipments that UNP makes to strategic West Coast ports. The Wall Street Journal reported “The labor dispute that caused months of gridlock at West Coast ports may be over, but the disruption is expected to redraw the trade routes that goods take to reach U.S. factories and store shelves… This is bad news for West Coast ports, truckers and railroads already worried that the expansion of the Panama Canal, due for completion next year, would begin to divert more business to the East Coast. Already it is expected to take three to six months for West Coast ports to return to normal.” (Wall Street Journal, March 5, 2015)

“We May Be Affected By Fluctuating Fuel Prices.” This noticeably impacted the company in 2014 as oil (and subsequently diesel fuel) prices declined sharply. This was a good thing for UNP, but volatile fuel prices could move higher and hurt UNP’s profits.

Conclusion:

Union Pacific is a bet on the US economy. As an integral part of the US economy, Union Pacific will grow as the economy grows. As a strong free cash flow generator, UNP also has the ability to return cash to shareholders (via dividends) and increase earnings per share (by reducing the number of shares outstanding with share repurchases). UNP’s share price has underperformed the broader stock market in 2015 due to temporarily lower revenue from coal shipments, lower revenue due to West Coast port shutdowns, and volatility in fuel costs. The decline in share price has created an attractive entry point for investors. We own shares of Union Pacific (UNP).